The ratchet auction: A new method for efficient online sales

Draft of 2004.07.18 ☛ 2016.07.16

An idea came to me some days back. For the most part, it was inspired by my deep and carefully-considered abhorrence of eBay’s recent “marketing moves”, but it’s also (I think) a neat new idea.

I want to share it. I’ve seriously considered patenting it. Instead, I’m just going to throw it out there into the realm of public discourse—and prior art. If you think it’s a good idea, please do take a minute to read the Creative Commons license wording down there in the bottom right of the page—it’s important.

Background

It’s difficult even in the best circumstances for collectibles and one-of-a-kind items to sell at a fair price. I’m talking about things that aren’t commodities. Things for which there is little or no competition. To summarize a whole lot of advanced marketing research and complicated economics in one partial sentence: the problem lies in the sparsity of potential customers, the diversity of reasons they might want the thing, and the difficulty of letting the right people know it’s for sale. And some other places, too.

In real-life markets, whether they’re Yankee auctions or double auctions (stock) or fixed-price storefronts, non-commodity items are (I’ll declare without scholarly justification) a typically underpriced. Read about the Revenue Equivalence Theorem if you want to understand it the way classical economics approaches this, but realize that this important result depends upon assumptions like multiple people interested in each item are present at the sale and every potential bidder is there for the full duration of the sale. Go buy and sell things like roadmaps and estate jewelry and antique horseshoes—or just attend two real-life estate auctions—if you want to really understand how the “crowd” affects the sale price of items.

Here’s the kicker: Online, it can be worse.

All that hype they (we) were tossing around during the dotcom revolution was simultaneously true and false. There are more people using the Internet to look at auction sales than there are attending any one seller’s physical shopfront or real-world auction: the extra people are out there. So based on that alone, the odds seem to be higher that somebody who’s interested in your exact item might find it. But in the same period, it has become so incredibly easy to create an online sale that there are more things for sale, making it far, far harder for these more numerous customers to find your particular stuff. Tragedy, meet Commons. Commons, Tragedy.

If there aren’t enough people seeing the offering, then there surely is less chance of an up-bid in an auction format sale. Keep in mind that both auction and fixed-price sales typically need to be seen by multiple interested parties before the price approaches a fair value: Auction pricing depends on up-bids to discover prices, and sellers using fixed price sales need to be able to adjust prices upwards between sales to discover fair price. In either case, the time-scale needed to wait until they happen by with their money in their hot little hands is longer than the time the price might normally change.

In brief: unfindable offerings command decreased prices.

It’s interesting to consider that eBay’s and Yahoo’s Yankee-style auctions typically last for seven to ten days. Originally, when these venues were new and there were far fewer items on offer than there are today, that was enough time for multiple interested bidders to see the sale and decide whether to bid or not. Now that there is an overwhelming assortment of offerings, and findability is gone, the 7-day auction is arguably no better than a 1-day auction, and just a cash cow for eBay (who charge by the listing). Browsing eBay categories in which there are a mix of commodities and collectibles, such as Books, you’ll see a strange dichotomy: There are hundreds of copies of a commodity bestseller like Cold Mountain on offer, and insofar as there are sufficient buyers to generate demand, the market is liquid and fair pricing is active—you can see multiple bids on many of the books, and the final prices are very similar for similar quality.

But look at the antiquarian books, the “collectible” books, each much scarcer than a commodity book. Even though the collectibles dominate eBay’s listings in aggregate, you will see that very few sell, and those that do typically sell with one bid.

There’s no up-bidding for collectibles, even though online sales are supposedly made for these items. I can think of at least two ways to interpret this. One is that the seller has set the starting bid too high for the market to support—but the $3.99 I pay on eBay these days for a truly rare old book doesn’t strike me as overpriced, even if it’s in rough condition. The other, more reasonable interpretation is that there are too many sales competing for the limited attention of the bidders. They simply don’t encounter the sales in which they would be interested.

Illiquidity.

And as eBay and the other major consolidated venues continue to dominate, I can’t see how the situation can improve for sellers, and as a consequence for the centralized venues. Commodities will sell at fair prices with multiple bidders, simply because even the most inexpert customer can’t swing a cat without hitting one. Search works. But the specialized items like antiques and collectibles are lost against the background of the commodities, and lost among one another.

People don’t have time to find things.

What is a Ratchet Auction?

Some days ago I wrote about Dutch (descending) auctions, and proposed the notion of the Drunkard’s Auction, in which the price makes a random walk up or down each tick, where the earliest, highest offer matching the current price is the closing price.

I like the Drunkard’s Auction format because unlike the more common Yankee (increasing) auction or even the traditional Dutch auction, it never ends until somebody makes an offer. If nobody has come along, it may wander on in its random walk, visiting all possible prices eventually. Even when somebody makes an offer at a fixed price, it may still take some time before the walk matches that price. That’s a good thing, I’ll argue, when you’re offering an item a shallow market like collectibles.

That said, it has some flaws. It’s random. If you sample the price at random, it tends to sit in the middle of the specified range.

In response, I’ve concocted this:

Suppose the seller has an item they want to offer in an online sale, but because it is unusual (an antique or collectible) they have (a) a poor idea of a fair fixed price that will not tie it up in their inventory, and (b) no expectation that sufficient audience will be present during the course of a limited-time increasing auction to drive the price up to a fair one.

The seller initially sets several parameters defining the sale’s price dynamics:

- The maximum price is the starting price at which the lot will be offered.

- The minimum price is the lowest price the seller is willing to accept for the lot.

- The discount increment is the amount the price will typically drop between two steps of the sale.

- The price persistence is the length of time a price is in effect before it changes again automatically.

- The ratchet probability is the chance that the price will jump up rather than dropping down by the discount increment

- The residual discount determines the amount of discount remaining when the price ratchets up.

(Does this sound like a lot to juggle? As it turns out, I suspect that many may be set to default values, leaving only the maximum price, minimum price and price persistence as things that might be set by the less controlling seller.)

The lot is offered for sale at the maximum price initially. Periodically thereafter, at fixed times determined by the price persistence, there is a random change in the price. For a ratchet probability p, there is a probability (1-p) that the discount will increase (that is, the price will decrease) by the fixed amount of the discount increment, and a probability p that all but the residual discount will disappear.

Finally, if the price is so low that the next discount would drop it below the minimum price, then it will instead revert to the maximum price (wrap around).

Potential customers have two options: They may buy the item at the current asked price. Or they can make an offer, a public promise to buy the item when the price crosses a specified price level.

Let’s play with an example. Suppose the maximum price is $100, the minimum price is $10, the discount increment is $1, the price persistence is 1 hour, the ratchet probability is 3% and the residual discount is 1/6. The online sale starts at a price of $100, and every hour thereafter there’s a 97% chance that it will drop by another dollar and a 3% chance that it will jump back up 5/6 of the way to $100. Say at one point it’s at $64: at the end of the hour, it will either drop to $63 or jump up to $94. If somebody comes along and buys the item outright before the end of the hour, they pay $64; if they make an offer at $63 or $63.99, then they have a 97% chance of winning (assuming there are no other offers that precede theirs, or are for higher bids). If the price should happen to ratchet up, then their offer to buy at that price stands until they change or cancel it. And if nobody comes along, and the price drops to say $10.12, then the next time the price changes it will either jump all the way back to $100 (97% chance) or it will ratchet back up to somewhere less than that (3% chance).

Now, I’ll just state without detailed supporting argument that a successful web-based sale using a Ratchet Auction will depend not merely on the traditional information supplied by auction sites—pictures, description, condition, current price and the like—but also will require that the exact probabilities of prices in the near future, and bidder interest in the item are disclosed.

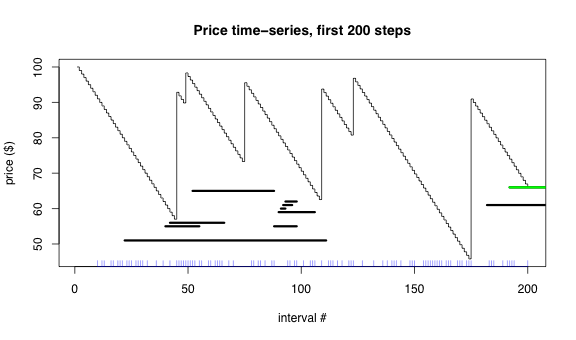

So let’s imagine that for each auction item there is a little time-series graph showing the price over the recent past. This graph is annotated very clearly to indicate the exact time that the price will next change, and what the values will be. It is annotated to show the web page views for the auction as little tick-marks along the time axis. It is also annotated with a horizontal line showing every open offer, starting at the time it was logged, and at the price offered. Like this:

A graph rather like this one is shown to anybody viewing the sale web page. It shows the price, the page views, and the offers. It shows the community’s interest in the item, and the timing and prices of the offers are signals to the seller about the general market for the offering.

The price time-series is that little stair-stepping line, which steps down (likely) or ratchets back up (rarely) every tick of the clock—forever, if nobody ever buys the damned thing. Every time anybody views the page, an indicator is added to the graph (those rather inadequate little blue ticks along the bottom of the graph are supposed to represent that). So people know how many others are watching. If anybody wants to buy the item at the current price, they can—in our example, nobody has done so. Instead, a number of people have made offers, indicated by those broad horizontal lines. As soon as any user enters an offer, everybody gets to see it. Whenever any offer is crossed by the price, that person wins (the green offer line is the winner, in this case).

I’ve tried to indicate a little of what I think might happen in this cartoon: First, that offers can be canceled or changed by the bidders. Second, that lowball offers (like that long line low on the left) will take forever to close. Third, that bidding wars and up-bidding can occur here just as in a Yankee auction (witness the little ladder of offers in the middle). Fourth, that the past doesn’t matter—an offer that is expired or changed is no longer binding, as is the case with the person who made an offer of about $65 between steps 50-80; even though the price subsequently drops below that offer, it’s been canceled or moved, and so they don’t win.

That’s it. The sale will continue adjusting the price with no intervention from the seller. Some small amount of web-based infrastructure would be needed to update the graphs and keep track of and report the offers. At some point—whenever prospective customers happen to come by—they will buy the item outright or make an offer. As noted above, lowball bids will take a long time for the price to reach that level, and there’s a significant risk that some more reasonable person will come along and buy the item at a higher price.

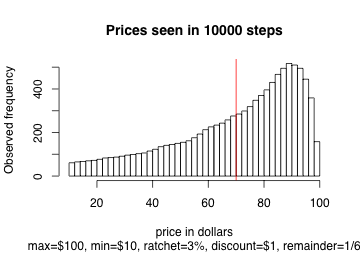

There’s a lot of tuning that one can do, too. You might imagine, given the numbers I’ve used here ($100 max, $10 min, $1 increment, 1/6 residual, 3% ratchet probability) that the price will spend a long time way down low. Nope:

This is a histogram of prices seen in 10000 steps of the same time-series used in the previous figure. The red line indicates the mean price over time—somewhere up around $72. Counterintuitive, after looking at the prices in the first figure? Here’s a hypothesis for some nice empirical economist to test in the future: I think that these simple-seeming downward trends overwhelmingly trigger our instincts about momentum, tricking us into thinking the price is headed for $0 every time it continues on down for a while.

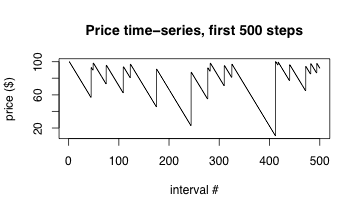

Here are a few more steps (500)—trace along and make a prediction, based on this sample, of the average price. I betcha you’re waaaaayyyy underestimating it. I know I do. If you were presented with this graph, and you actually wanted to bid on the item, what would you bid? How rational are you feelin’, punk?

No, wait—it gets better with more transparency. The auction listing should not only fully disclose the historical prices, the page views, and the timing and prices of offers, but should also explicitly state the probabilities and the possible prices in the next tick. As in “there is a 3% chance the price will be $50, and a 97% chance that it will be 22.” And also explicitly list every person who has made an offer, what its price level is, and and how different offers are in effect. What we want, honestly, is to pressure the visitor into buying now or making a higher offer than anybody else’s. And transparency is the key to that.

Unlike a Yankee (eBay-style) auction sale, lowball offers are postponed, not immediate. In a ratchet auction, it seems that the incentive to bid is spread out more evenly in time, whereas a Yankee auction increases pressure to bid towards the scheduled endpoint. By spreading out the pressure to bid, I’ll argue that a ratchet auction caters to asynchronous visits by potential customers, could as a result lead to improved sales prices in situations where you do not have the full and synchronized attention of the marketplace.

Like an online site, say.

Ron Jeffries notes that what I’ve described now could be managed by hand by a seller, if the period was sufficiently long. You could, I suppose, just change the prices in your storefront and update the accompanying graphs, and accept offers via email. There is a small matter of getting the customers to trust that you’re not ratcheting the price up in response to their offers—but you know, there always is, isn’t there? And there’s still a problem in getting people to see your offerings in the first place.

Sounds like there are some things left unresolved. I have some ideas, but I’m tired. I’ll get to them in a bit.

In the meantime, consider how it is you came across this little entry of mine. There are so many other things for you to read. How is it that you’re here, now?